|

|

||||||||||||||

|

|

CHAPTER 3

The

Essence of the Business Cycle

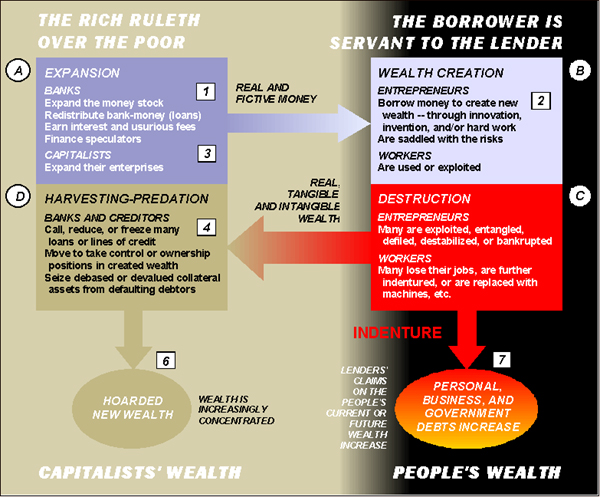

What is the essence of the business cycle? How do Capitalists exploit it? What dangers can unfold from it? These questions are complicated, but they have strikingly simple, albeit disturbing, answers. Before I proceed, I must introduce David Bohm's concept of implicate order.1 I do so because Bohm's concept is not restricted to physics (Bohm was a physicist); but, provides, as I will show, a new way of formulating and thinking about economics. David Bohm's Implicate Order. The scientific understanding of nature is the ultimate object of physics. The scope of modern scientific enquiry encompasses physical objects and life, including human consciousness and intelligence -- how we think, and how we conceive the world. Until around the beginning of the 20th century, physicists conceived the universe as being divisible into parts -- separable, independent, or autonomous. Particles were separate material fragments with definable boundaries and limits. Material processes were divided into separate independent subprocesses. Most important, the observing apparatus and the observed object were assumed to be independent and non-interacting. The division of the world into fragments was a convenient, simplifying abstraction. Where does the fiction of the old world order come from? The need to fragment and divide the world has a long history. It is rooted in the need to dominate -- control, command, acquire, and possess -- things. Aristotle told us: an article cannot be acquired as property unless it can be separated from its possessor.2 Locality and separation unable possession. Division creates a fictitious world order which facilitates dominion over things, including humans -- as things, slaves, or servants. Relativity and quantum mechanics challenged the old world order. Einstein's relativity requires continuity, locality, and causality; Heisenberg's quantum mechanics requires discontinuity, nonlocality, and uncertainty.3 For scientists like David Bohm, the notions of form, order, and structure -- the whole reality of the universe -- cannot be conceived as anything but an "unbroken wholeness."4 For Bohm, locality and separability give way to nonlocality and to undivided wholeness. Particles cannot be separated from their whole context; the quantum mechanical wave function of the "whole system" -- not of fragments -- determines the forces between particles.5 The observing instrument, and what is observed, are not separable. Order emerges from "deep unity" -- it is enfolded in a single structure that cannot be fragmented.6 To explain this new notion of order, Bohm used the analogy of a hologram.7 The hologram enfolds the image of an object. Proper illumination of the hologram reveals the image -- which he called the explicate order. Bohm used the word enfold because there is no point-to-point correspondence between the image and the hologram.8 Every part of the hologram enfolds the image of the object. The illumination of the hologram unfolds each region into the whole space. Bohm called the order in the hologram implicate; and the unfolded order, obtained by illumination, explicate. Order is enfolded from the object onto the hologram, then unfolded, through illumination, from the hologram into the object's image.My aim here is to explain how the economic order in a capitalist society -- the order implied by the business cycle -- is essentially enfolded in the space-time distribution and structure of money, including bank-money as loans. The basic idea is this: money patterns provide the essential implicate order of the economy; the people who control this implicate order control the economy. Following Bohm's logic, the economic and social unfolding of this implicate order must be viewed as an unbroken whole. For example, the distribution of commercial real estate loans determines the level of construction activity; but it cannot be separated from non-accrual loans, bankruptcies, foreclosures, etc. This is especially true if the distribution of bank loans entails excessive speculation and overinvestments. The stability of small businesses is not independent from that of banks. Together, economic and social observables form a connected, unbroken economic whole. The unfoldment of the implicate social and economic order is manifest in all social and economic changes -- constructive and destructive. In Book II, I gave a Model and partial theories of the business cycle. The Model is supported by corroborative empirical data showing the time-evolution of key financial, economic, and social variables. The Model reveals links and connections (lagged correlations) between these variables; it also unconceals how the effects of the space-time distribution and structure of money, including bank-money, can be propagated through society. Using the Model, and theoretical insights derived from Heidegger (Capitalism as technology for dominating Man as servant) and from Bohm (the business cycle as recurring enfoldment-unfoldment), I am in a position to reveal the fundamental theory of the business cycle. The Business Cycle is the primordial manifestation of the Nietzschian Eternal Recurrence of the Same in Capitalism. Its implicate order is enfolded in the space-time structure and distribution of money (the pattern of money), including, especially, bank-money. The empirical evidence strongly suggest that the cycle is controlled and maintained for the benefit of the ruling few. Its cyclical movement can be thought of as consisting of four elements (see Plate 3-1):

(A) Expansion. To initiate the up-side of the business cycle, financial institutions do two things: they expand the money stock by creating credit (bank-money is expanded in the form of contracts and acknowledgments of debts); and they redistribute bank-money in the form of loans and credit.

(B) Wealth Creation. Entrepreneurs use bank-money (real or fictive) and workers to create new wealth. The means of production are usually separated from workers. When possible, these are even separated from the entrepreneurs themselves. In addition, loans are typically heavily collateralized; tangible and intangible property (real property, means of production, inventory, patents, copyrights, trademarks, etc.) of funding-limited entrepreneurs are pledged as collateral for the benefit of capitalists and usurers. Let me use Hegel's philosophy (Lordship and Bondage) to explain the essential relationship between the entrepreneur and the usurer. The usurer's self-consciousness, as usurer, is that of being-in-and-for-himself, while that of the entrepreneur and of his employees, as workers, is that of being-for-another,-- the other being the usurer.9 The Thing that connects the usurer as lord to the entrepreneur as bondsman is the to-be-created wealth. The entrepreneur makes use of the employees, and both are made use of by the usurer. The usurer can hold the entrepreneur in subjection. If the entrepreneur succeeds in exploiting his invention or innovation through his workers, and if he satisfies the desire and enjoyment needs of the usurer (that is, if he delivers obediently usurious interest and fees to the usurer, if he delivers taxes to the State, and if he gives form and shape to new wealth which can be appropriated, misappropriated, or expropriated), his self-consciousness transmutes from being-for-another to being-in-and-for-himself. Unfortunately, no sooner than his consciousness is so transformed, the successful entrepreneur discovers that his own "satisfaction is itself only a fleeting one, for it lacks the side of objectivity and permanence."10 The potential loss of his new wealth to the usurer at any moment is the basis of the entrepreneur's fear and continued servitude. The potential loss of his job is the basis of the worker's fear and continued servitude. The apparent self-will and freedom of all -- usurer, entrepreneur, and worker -- are "enmeshed in servitude."11

(C) Destruction. Speculators, financed by usurers, gamble for quick profits. Speculative activities are an integral part of the usurers' UNITÉ DE PLAN; they are a mechanism of choice for the quick transfer of wealth to gamblers and to their backers. More important, they signal the beginning of the down-side of the business cycle -- the activation of the Destruction and Harvesting-Predation elements. Usurers tighten credit. This can be authenticated again and again: many loans to entrepreneurs are called, frozen, or reduced; many entrepreneurs are entangled or destabilized, then defiled or bankrupted. Many creditors, including honest creditors, overstep their limit. Big financial institutions swallow up smaller weaker ones. The struggle between enlightened entrepreneurs and superstitious creditors (and their agents) interferes with the otherwise undisturbed domination of rich usurers.12 Many sound entrepreneurs, and their workers, are entangled, used up, or victimized by usurers-speculators, following failed overinvestments; rightly or wrongly, many usurers are accused of trickery, deception, cunning, evil intentions, etc. The aims, goals, and plans of entrepreneurs and usurers become deeply divergent. To quote from Hegel, "both parties generally stand within the limits of the same circle of transient and corruptible existence."13 Both parties become alienated from themselves, and from each other. (The credibility and extent of the destruction can be assessed from statistics on fraud incidents reported to police, business and consumer bankruptcies, court action, etc.) The high cost of defending the entrepreneur's legal interests against the deeply entrenched net advantages of rich Capitalists becomes manifest to the entrepreneur. The deception of the Capitalist priesthood boils to the surface.14 Self-alienation and disconnection from society as the whole multiplies. Latent dejection and rebellion against the Capitalist Order of lordship and bondage -- as False Ideal, as Irrational World Order -- is suddenly brought forth to the fore of consciousness. (D) Harvesting and Predation. The objective of the expansion-and-distribution of money becomes manifest in the down-side of the business cycle. It is to induce entrepreneurs to create new wealth for Capitalists. The usurer's interest in this process goes something like this:

The money stock is controlled by monetary authorities (which can print money and influence interest rates). The "creation of credit" (or bank-money in the form of acknowledgments of debt) and the redistribution of bank-money (in the form of earning assets, including loans) are effectively controlled by banks. The simple act of redistributing money as loans (e.g., by canalizing more deposits into commercial real estate loans) allows banks to exercise control over the economy and its evolution. Of course, the spheres of influence of banks depend on the size of their assets. Big banks have a global or national sphere of influence; small banks have a provincial or local sphere of influence.

At any moment, the intensity and distribution of the money stock, including loans, enfold the economic order of the business cycle -- together these provide the implicate order for the business cycle. The 'now-not-yet' unfolding24 of the business cycle is implied in the dynamic changes in the distribution of the money stock -- as money and as bank loans. Every change in the distribution of money and loans signals a new order -- the signal propagates as a chain of causal influences. The statistical potentialities that are implied in the money-and-loan distributions become manifest as increases or decreases in a variety of economic, social, and other variables. The economic variables include: the number of building permits, the capacity utilization rate in manufacturing, the prime lending rate, the T-bill rate, the exchange rate, non-accrual business loans, non-accrual residential mortgages, the number of consumer and business bankruptcies, the unemployment rate, the number of foreclosures, personal debt, government debt, etc. But the potential reach of money-and-loan policies is by no means restricted to economic variables. The explicate order can include increases or decreases in: the number of fraud incidents reported to police, the number of homicides, the number of suicides, the number of hospital discharges for acute myocardial infarctions ("heart attacks"), etc. In other words, a whole range of economic, social, health, and other phenomena are implied in the distribution of money. In a capitalist society, the distribution of money and the implied phenomena are inseparable -- they constitute an undivided wholeness,25 an undivided reality. When banking and associated commercial powers are concentrated in a few banks, as is the case in Canada, the structure and distribution of loans at the top banks encodes much of the implicate economic order of the business cycle. In other words, much of what can happen in Canada is, to a large extent, encoded in, and determined by the changes in the structure and distribution of the money stock -- including bank-money. The space-time structure and distribution of money is, to use Bohm's analogy, the "hologram" (the implicate order) of the business cycle. The unfoldment of wealth creation occurs during the first two sequences of the business cycle (elements A and B); its enfoldment during the last two (elements C and D). The unfoldment is the up-side of the cycle; the enfoldment, the down-side. In a Capitalist society, the enfoldment-unfoldment movement is repeated ad infinitum -- it recurs eternally. The Harvesting and Predation element (element D) of the cycle spawns the Expansion element (element A) of the next cycle simply because continued predation and destruction ultimately "recoils upon the perpetrator -- reacts upon him with destructive tendency."26 The new business cycle is a repetition of the Same cycle. An infinite number of changes and variations of the movement of the cycle are possible; but the configuration, the character, and the potentialities of the business cycle are always the same.27 This is because the cycle's Solomonic seed -- its code [Proverbs 22:7] -- is the Same. The recurrence, the self-sameness, of the business cycle as manifold is what secures the dominion of the Capitalist. Every recurrence of the business cycle projects the "veiled truth of Being"28 of Capitalism -- the future determined from the unfolding of the past. Ideally (at least, according to the propaganda of the marketplace), the business cycle is supposed to increase the wealth of the people. If it does not, then Capitalism fails -- instead of increasing the number of capitalists in the world, Capitalism increases the number of the indentured and their debt. It is precisely this failure that the Money Trust must avoid if they want to perpetuate their Nietzschian "will to power" -- otherwise, they will suffer the "will to power" of the indentured electorate. Nietzsche's "Eternal Recurrence." For Nietzsche, the "circular movement" is nothing but "the will to power" -- a "selective principle" in "the great dice game of existence."29 For him, the world is a "Dionysian world of the eternally self-creating, the eternally self-destroying . . . without goal." Why did Nietzsche believe in eternal recurrence? Because it is demanded by the laws of physics -- the conservation of energy (conservation of volume in phase space).30-31 Contra Nietzsche -- Tipler's "Eternal" Progress. Eternal Recurrence has its detractors. One such detractor is Frank J. Tipler, a physicist who specializes in general relativity. Tipler rejects Eternal Recurrence; instead, he believes in the possibility of eternal progress.32 Past detractors included Herbert Spencer (a supporter of capitalism) and Friedrich Engels (a supporter of socialism).33 For Tipler, "eternal progress is not only possible but inevitable" (barring any disaster from Heat Death).34 Tipler supports his belief with a proof of the General Relativistic No-Return Theorem (the proof assumes that the universe, while spatially finite, "must be infinite"35 [Tipler's italics]). According to Tipler, the proof of the No-Return Theorem, guarantees that the growth of knowledge is unbounded; and that per-capita wealth will grow ad infinitum.36 As far as I can tell, Tipler's proof reveals nothing about the future distribution of knowledge and wealth. The distribution of knowledge and wealth is the nexus of progress. Tipler asserted that per-capita wealth can grow ad infinitum. What does this mean? That everyone will ultimately be able to afford his or her own galaxy? or, that all the galaxies will be owned by a few Big Capitalists with a franchise to colonize and exploit the universe? The precise nexus of progress is bound up with how progress affects our being. Anyone who does not grasp this reality is confused or misguided. Who should we trust? Those who believe in Eternal Return? or those who believe in Eternal Progress? For supporters of Capitalism like Herbert Spencer, progress is predicated upon increasing "heterogeneity"37 -- a free market with increasing differentiation between rich and poor. For them, homogeneity is to be abhorred. It is, to quote Spencer, "a condition of unstable equilibrium."38 How do you get heterogeneity? For Spencer, the division into "separate classes" is brought about by the "development of intelligence."39 What unadulterated nonsense! The fact that boulders can be segregated from pebbles by the force of gravity40 does not imply that more money implies more rights in the marketplace. It is not the laws of nature that segregate rich masters from poor servants, or the lender from the borrower; it is the malignant artifice of the Solomonic creed. The champions of progress abhor the theory of the Eternal Recurrence of the Same. The irony, of course, is that Capitalism is nothing but Eternal Return of the Same. The business cycle is the enemy of progress, because of its recurring irrational destruction and predation. Destruction and predation are nothing but mechanisms for transferring the spoils of progress -- from entrepreneurs and working people (servants) to capitalists and usurers (their masters). The business cycle is, therefore, nothing but an eternal struggle between rational forces for good (innovation, invention, and wealth creation) and irrational forces for evil (usurious exploitation, sadistic or wicked destruction, and wealth predation). It is clearly a defective implicate order -- which the G7 countries must change, if they want to survive in the next millennium. Why the Champions of Progress Abhor Historicist Doctrines. Karl Popper held that the great German philosopher Hegel, was an enemy of the Open Society. In Popper's words: " . . . Hegel's hysterical historicism is still the fertilizer to which modern totalitarianism owes its rapid growth . . . Thus the formula of the fascist brew is in all countries the same: Hegel plus a dash of nineteenth-century materialism (especially Darwinism . . . )."41 How ironic? British and other transatlantic trade subjugated millions of blacks as slaves in the colonies. The sun did not set on millions more who were dominated by imperialism. Fascism was a recurrence of the same ugly essence of domination and human destruction (except that Nazis focused their destruction, not on blacks, but on white Europeans and Jews). Why the poisonous attack on Hegel's historicism? Hegel's historicism is a simple idea. It goes something like this: if you want to know the "hidden, undeveloped essence"42 of a person (say Hitler) or of a state (say England), you must investigate the history of that person or state. In the absence of prescience or divine revelation, only history, as record of change, can undisclose, unhide, unconceal the hidden essence. It is simple: the history of a rapist reveals the rapist as rapist. Without change, the undeveloped essence of the rapist remains undeveloped and hidden. So why the poisonous attack? My suspicion is that the so-called champions of the free marketplace have something to hide. God forbid, a thorough investigation of the historical practices of the marketplace may unconceal some recurring pattern or machination which, if unconcealed, would not be tolerated by the electorate (imagine being sold as slave by slave traders who are financed by credit!43). God forbid, citizens may discover that they are nothing but voting indentured servants -- under the spell, not of Hegel or Heidegger, but of the Solomonic creed [Proverbs 22:7]. Heaven forbid, they may even act on their findings. The doctrine of Capitalism is due for a major overhaul. Its foundations are not secure. Its supporters, like the Dominican friars of the 16th century, have difficulties accepting that Capitalism, not unlike the Ptolemaic system, is a defective world order. Better systems are not only possible, they are inevitable. The Holy Office destroyed Galileo; but it could not destroy the Truth. The empirical evidence from Copernicus, Kepler, and Galileo was more enduring than the Ptolemaic doctrines of the Holiest of Offices. Even Newtonian mechanics had to give way to Quantum Theory and to Relativity. Capitalism, too, will have to give way to a sounder doctrine. The whole philosophical foundation, the whole legislative and economic configuration, the whole character, direction, and logic of Capitalism must change.

|

|

| 1

For the concepts of implicate and explicate orders, see: David Bohm, Wholeness

and the Implicate Order, 1980. For a more technical presentation, see David Bohm and

Basil J. Hiley, The Undivided Universe, 1993, at 6, 10, 176-180 ("indivisible

wholeness"), 289 (inconsistency between relativity and quantum theory), and 350-392

(Quantum Theory and the Implicate Order). For the concept of "the unfolding of

a projection," and its grounding in metaphysics, see Martin Heidegger, Nietzsche,

translated by David Farrell Krell, Vol. II: The Eternal Recurrence of the Same, at 116-117

(in The Character of "Proof" for the Doctrine of Return). 2 Aristotle, Politics, translated by Ernest Barker, revised with an Introduction and Notes by R.F. Stalley, 1995, at 12-20. See, especially: 1254b13, on separation of property from its possessor; and, 1255b16, on slavery).3 David Bohm and Basil J. Hiley, The Undivided Universe, 1993, at 289 and 351 (inconsistency between the notions of order in relativity and in quantum theory), and 350-392 (Quantum Theory and the Implicate Order).4 Ibid., at 176-180 ("indivisible wholeness"), and 352 ("unbroken wholeness").5 Ibid., at 10.6 Ibid., at 176-177.7 David Bohm and Basil J. Hiley, The Undivided Universe, 1993, at 353-357 (hologram).8 Ibid., at 354.9 G.W.F. Hegel, Phenomenology of Spirit (1807), translated by A.V. Miller, with Analysis of the Text and Foreword by J.N. Findlay, 1977, at 111-119 (Lordship and Bondage), and 343 (being-in-and-for-self and being-for-another).10 Ibid., at 118.11 Ibid., at 119.12 For related ideas and concepts, see G.W.F. Hegel, Phenomenology of Spirit (1807), translated by A.V. Miller, with Analysis of the Text and Foreword by J.N. Findlay, 1977, at 329-349 (The Struggle of the Enlightenment with Superstition), especially 330 ("trickery" and "undisturbed domination"), 335, and 342-343.13 G.W.F. Hegel, The Philosophy of History, translated by J. Sibree, with Prefaces by Charles Hegel and J. Sibree, and an Introduction by C.J. Friedrich, 1956, at 67.14 See Hegel's view on how the mass of people are "befooled," and are "the victims of the deception of a priesthood" in Phenomenology of Spirit, 1977, at 330.15 Heidegger's expression; Martin Heidegger, Being and Time, translated by John Macquarrie and Edward Robinson, 1962, at 98 ("manipulability" and "readiness-to-hand").16 The notion of discovery of truth or deceit (in the sense of cover up) in an 'agreement' is elaborated in Heidegger; ibid., at 55-58 (The Concept of the L o g o s).17 Heidegger's expression; ibid., at 163 ("they are what they do").18 Heidegger's expression; ibid., at 376 ("I am-as-having-been").19 Heidegger's expression; ibid., at 436 (repetition of the having-been).20 Heidegger's expression; ibid., at 443 ("understand[ing] the 'past' in terms of the 'Present'"; anticipatory repetition).21 Heidegger's expression; ibid., at 398-399 (on forgetting "what has gone before").22 Heidegger's expression; ibid., at 436 ("readiness for adversities").23 Heidegger's expression; Martin Heidegger, Being and Time, translated by John Macquarrie and Edward Robinson, 1962, at 447 ("The historiological disclosure of the 'past' based on fateful repetition . . . guarantees the 'Objectivity' of historiology"), and 458 ("the 'now-not-yet'").24 Heidegger's expression; see Martin Heidegger, Nietzsche, Vol. III: The Will to Power as Knowledge and as Metaphysics, translated by Joan Stambaugh, David Farrell Krell, Frank A. Capuzzi, edited, with Notes and an Analysis, by David Farrell Krell, at 163 ("The past as essentially unfolding").25 Bohm's expression; see D.Bohm, Wholeness and the Implicate Order, 1993, at 11 ("Undivided Wholeness").26 For insights on the historical impact of destruction of goods and chattels, see G.W.F. Hegel, The Philosophy of History, translated by J. Sibree, with Prefaces by Charles Hegel and J. Sibree, and an Introduction by C.J. Friedrich, 1956, at 28.27 Ibid., at 54-79 (The course of the World's History), especially 54-55.28 Heidegger's expression; see Martin Heidegger, Nietzsche, Vol. III: The Will to Power as Knowledge and as Metaphysics, translated by Joan Stambaugh, David Farrell Krell, Frank A. Capuzzi, edited, with Notes and an Analysis, by David Farrell Krell, at 163.29 Friedrich Nietzsche, The Will to Power, 1901, translated by Walter Kaufmann and R.J. Hollingdale, and edited, with Commentary, by Walter Kaufmann, 1967, at 544-550 (The Eternal Recurrence), especially 549.30 Ibid., at 547.31 For proofs of three Eternal Return Theorems (Poincaré, Finite Markov Chain, and Quantum Almost-Periodic Recurrence), see Frank J. Tipler, The Physics of Immortality, 1994, at 89-103 (Eternal Return), and 417-431 (Proofs of Eternal Return Theorems and the No-Return Theorem).32 Ibid., at 101-103 (No-Return Theorems in General Relativity), and 104-123 (The Triumph of Progress).33 Frank J. Tipler, The Physics of Immortality, 1994, at 105 (Herbert Spencer and Friedrich Engels).34 Ibid., at 104-123 (The Triumph of Progress), 67 (Heat Death), and 105 (Spencer's and Darwin's concern with Heat Death).35 Ibid., at 101-103 (No-Return Theorems in General Relativity).36 Ibid., at 104 (the meaning of "Eternal" progress).37 Herbert Spencer, First Principles, 1880, at 337-362 (The Instability of the Homogeneous).38 Ibid., at 337.39 Ibid., at 353.40 Ibid., at 386-406 (Segregation), especially 387.41 Karl R. Popper, The Open Society and Its Enemies, Volume II, 1962 and 1966, at 59 ("Hegel's hysterical historicism").42 Ibid., at 7-9 (the expression "hidden, undeveloped essence" is Hegel's; quoted in Popper, at 7).43 Jacob M. Price, Credit in the Slave Trade and Plantation Economies, in Slavery and the Rise of the Atlantic System, edited by Barbara L. Solow, 1991, at 293-339.44 Heidegger's expression; see Martin Heidegger, Nietzsche, Vol. III: The Will to Power as Knowledge and as Metaphysics, translated by Joan Stambaugh, David Farrell Krell, Frank A. Capuzzi, edited, with Notes and an Analysis, by David Farrell Krell, at 137-149 (Truth as Justice), especially 145.45 Ibid., at 148.46 Hayek's expression; see Friedrich A. Hayek, Law Legislation and Liberty, Vol. II: The Mirage of Social Justice, 1976, at 115-120 (The Game of Catallaxy).47 Martin Heidegger, Nietzsche, Volume II: The Eternal Recurrence of the Same, translated, with Notes and an Analysis by David Farrell Krell, at 115-120, especially 117 (The Character of "Proof" for the Doctrine of Return).48 Ibid., at 120.49 Ibid., at 119.50 Friedrich Nietzsche, Thus Spoke Zarathustra, translated with an Introduction by R.J. Hollingdale, at 225 (Of Old and New Law-Tables, number 19). |

| THE BUSINESS CYCLE THE DEFECTIVE IMPLICATE ORDER |

||||||||||||||||||||

|

||||||||||||||||||||